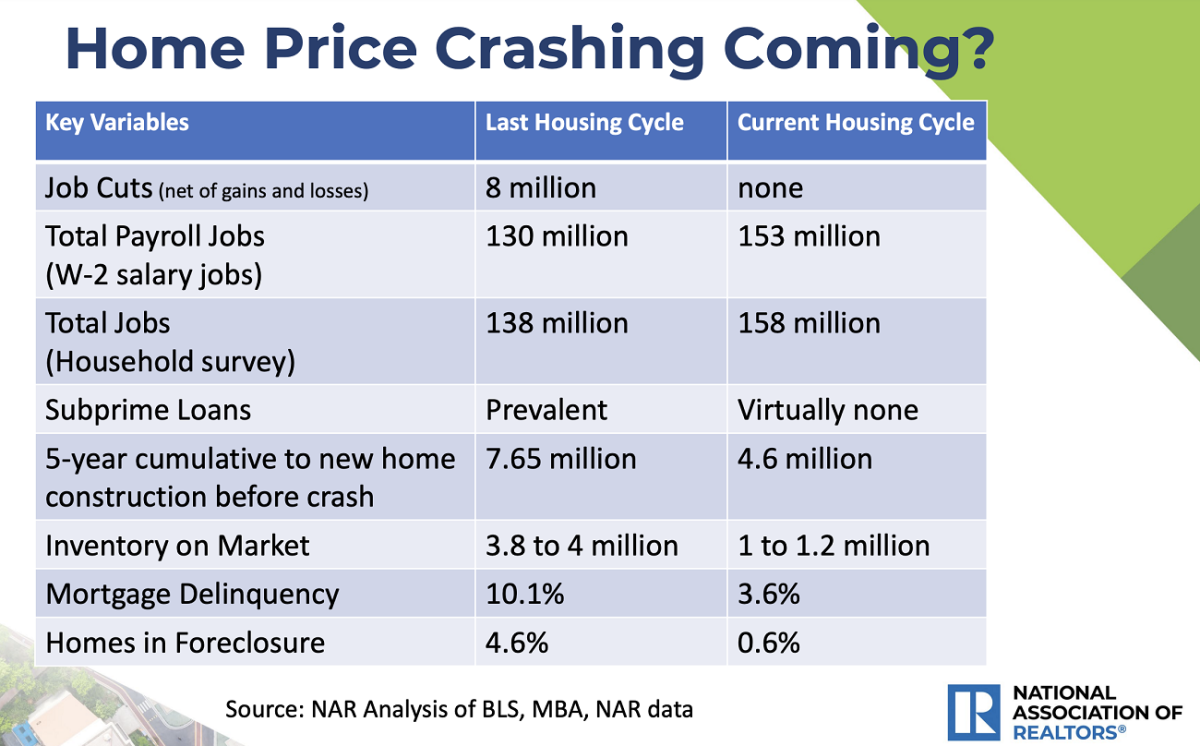

National Association of Realtors Chief Economist Lawrence Yun draws the distinctions between today’s real estate market and that of more than a decade ago.

Yun offered assurance that current dynamics are nothing like during the Great Recession. He pointed to several key indicators of how this market differs.

- The labor market remains strong. In the last major housing downturn, there were 8 million job losses in a single year. Now there are virtually none. Though layoffs in the technology and mortgage industries are occurring, they haven’t accumulated enough to form a net job loss, Yun noted. A strong job market bodes well for housing’s future.

- Less risky loans. Yun also noted the subprime loans that were prevalent during the 2008 housing bust are basically nonexistent today.

- Underbuilding and inventory shortages. New-home construction prior to the 2008 crash was amounting to 7.65 million units annually. Today, it’s 4.6 million. Yun points to “a massive housing shortage” from a decade of underproduction in the housing market.

- Delinquency lows. About 10% of all mortgage borrowers were delinquent on their loans in the previous housing bust. The mortgage delinquency rate is now at 3.6%, holding at historical lows, Yun said.

- Ultra-low foreclosure rates. Homes in foreclosure reached a rate of 4.6% during the last housing crash as homeowners who saw their property values plunge walked away from their loans. Today, the percentage of homes in foreclosure is 0.6%—also at historical lows, Yun said. He predicted foreclosures to remain at historical lows in 2023.